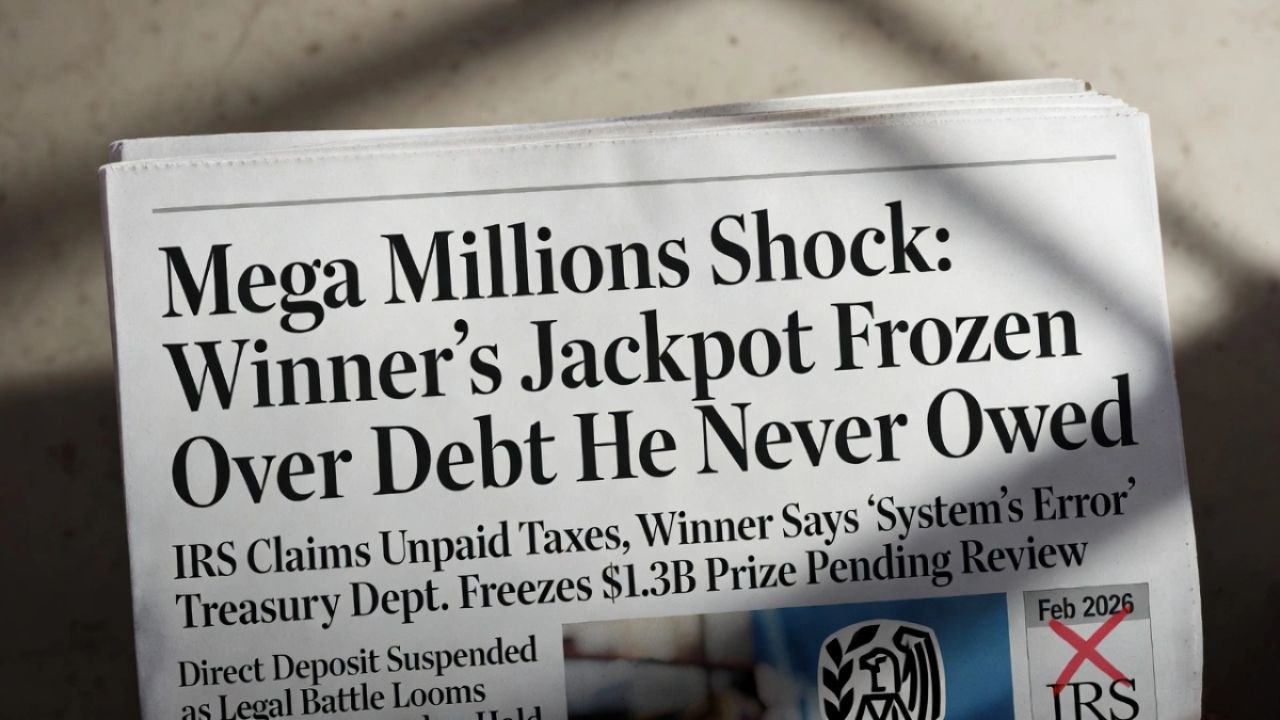

Winning the lottery is often portrayed as the ultimate financial breakthrough — a single moment that transforms a routine life into one of freedom and opportunity. But for one recent Mega Millions winner, celebration quickly turned into uncertainty when his jackpot was unexpectedly placed on hold over a debt he insists was never his.

The situation has sparked renewed discussion about how lottery prizes are verified, why payouts can be delayed, and what happens when financial databases make mistakes.

From Life-Changing Win to Administrative Freeze

After successfully matching the winning Mega Millions numbers, the winner expected the standard claims process: identity verification, tax documentation, and a scheduled payout. Instead, lottery officials flagged an alleged outstanding debt tied to his personal records.

As part of routine pre-disbursement checks, the system identified what appeared to be an unpaid obligation. Until the matter could be reviewed, the prize funds were frozen.

For the winner, the shock was immediate. Rather than preparing financial strategies and investment plans, he was forced into a dispute resolution process to clear his name.

Why Lottery Winnings Can Be Put on Hold

Large lottery prizes are not automatically transferred upon claim. Before releasing millions of dollars, state lottery commissions conduct extensive background checks to ensure compliance with legal and financial obligations.

Government Debt Offsets

In many states, lottery winnings can be used to satisfy outstanding government-backed debts, including:

- Unpaid child support

- State or federal tax liabilities

- Court-ordered restitution

- Certain public assistance overpayments

If databases show an active obligation, the lottery authority may freeze or partially offset the winnings before distribution.

These safeguards are designed to enforce financial accountability. However, the system relies heavily on accurate data matching.

How Debt Verification Works Before Payout

When a major prize is claimed, lottery agencies coordinate with state and federal databases to confirm identity and check for outstanding obligations. This process often involves cross-referencing:

- Social Security numbers

- Full legal name

- Date of birth

- Government-issued identification

If a match appears in the system, funds can be temporarily withheld while agencies verify the claim.

In high-value jackpots, even minor discrepancies can trigger additional scrutiny. With millions at stake, compliance procedures are strict.

When the Debt Isn’t Yours

In this case, the winner reportedly disputed the debt, claiming it was either a clerical error or connected to someone with similar identifying information.

Mistaken identity cases, though uncommon, can occur. Similar names, data entry errors, outdated records, or mismatched identifiers may incorrectly link an individual to someone else’s obligation.

When such disputes arise, the burden shifts to documentation.

The Dispute Process

If a winner challenges a flagged debt, they typically must:

- File a formal dispute with the relevant agency

- Provide supporting documentation

- Verify identity through official records

- Await administrative review

If the debt is proven inaccurate, the winner is entitled to receive the full jackpot without reduction.

However, the review process can take weeks — or longer — depending on the complexity of the case.

Financial and Emotional Impact

A frozen jackpot is more than a paperwork inconvenience. For winners, timing matters.

Many lottery recipients immediately engage financial advisors, tax professionals, and estate planners. Investment strategies, philanthropic commitments, and asset allocations often begin soon after claim approval.

A payout delay can disrupt:

- Investment entry timing

- Tax planning strategies

- Real estate purchases

- Public disclosure plans

Beyond logistics, the emotional impact can be significant. The abrupt shift from celebration to uncertainty creates stress during what should be a milestone moment.

The Legal Framework Behind Prize Holds

Lottery commissions operate under strict statutory guidelines. Most states require agencies to check for enforceable debts before releasing large sums.

This legal framework is intended to protect public interests, not penalize winners unfairly. Yet it also highlights a key reality: automated systems are only as accurate as the data they contain.

Administrative safeguards reduce fraud and enforce compliance, but occasional errors are an unavoidable byproduct of complex databases.

What Lottery Winners Should Do Before Claiming

While no system is perfect, proactive financial housekeeping can reduce the risk of payout complications.

Review Public Records

Before claiming a major prize, winners may benefit from:

- Confirming tax filings are current

- Reviewing credit and public record reports

- Resolving any outstanding government notices

- Ensuring identification records are accurate

Addressing discrepancies early can prevent unnecessary delays.

Assemble Documentation

Maintaining organized records — including prior tax returns, court documentation, and identification materials — can speed dispute resolution if needed.

Preparation is particularly important for high-net-worth transactions where verification is thorough.

Broader Lessons for Financial Systems

This case also underscores a larger conversation about database accuracy and identity matching systems.

As financial transactions become increasingly automated, the margin for administrative error remains small — but impactful.

High-value events such as lottery payouts expose how data mismatches can affect individuals dramatically. Continuous improvement in verification systems, identity validation technology, and inter-agency communication remains essential.

Protecting Your Financial Future After a Win

For lottery winners, patience and discretion are critical.

Financial professionals often recommend:

- Remaining anonymous if state laws allow

- Consulting legal and tax advisors before public disclosure

- Avoiding major commitments until funds clear

- Structuring long-term wealth management strategies

A temporary delay, while frustrating, is better resolved carefully than rushed.

Conclusion

The Mega Millions jackpot freeze serves as a powerful reminder that even life-changing wins are subject to regulatory and financial review.

While systems exist to enforce legitimate debts, administrative errors can occur. In such cases, documentation, swift dispute filing, and professional guidance are key to protecting rightful payouts.

Winning the lottery may feel instantaneous. Receiving the funds, however, is a structured legal process — one that demands precision, patience, and informed action.

Disclaimer: This article is for informational purposes only. Legal outcomes vary by jurisdiction and individual circumstances. Readers should consult qualified legal or financial professionals for personalized guidance.